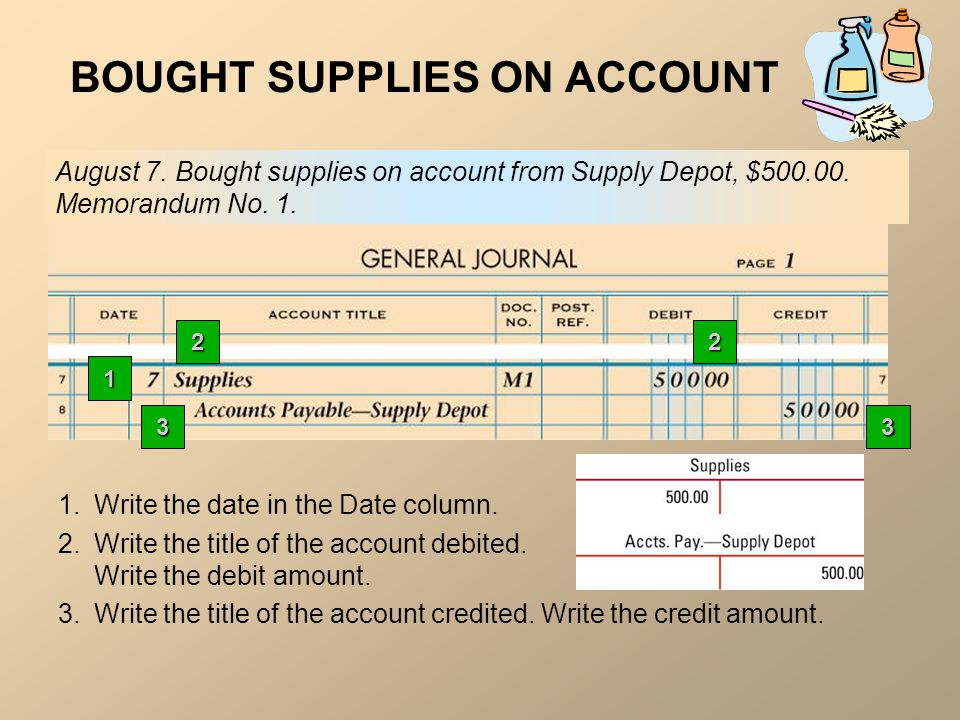

All Expenses and Losses. Nov 27 2007 0733 PM Journal Entry - Supplies bought on credit.

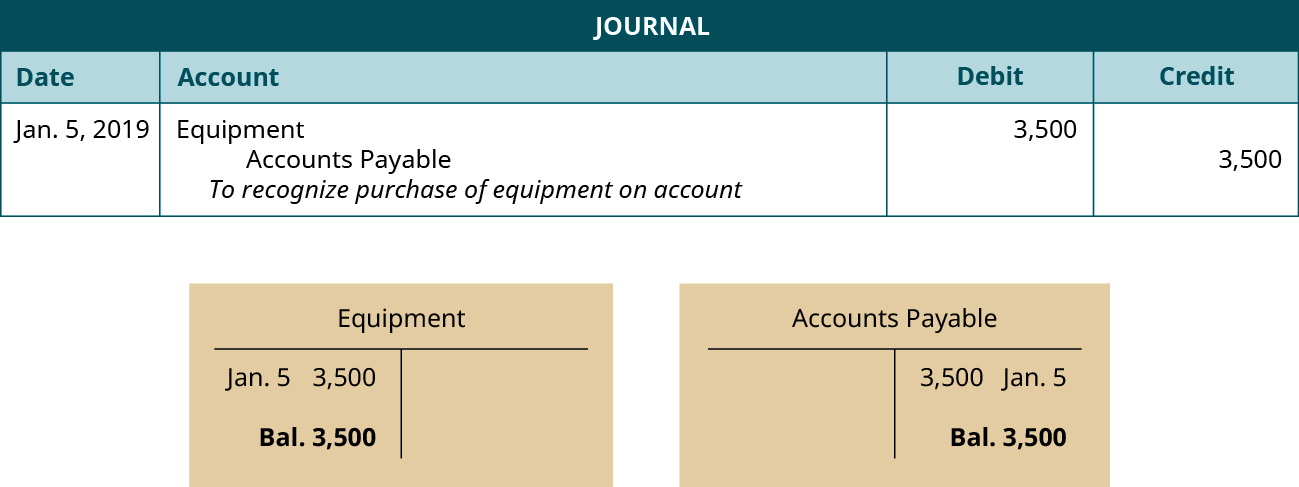

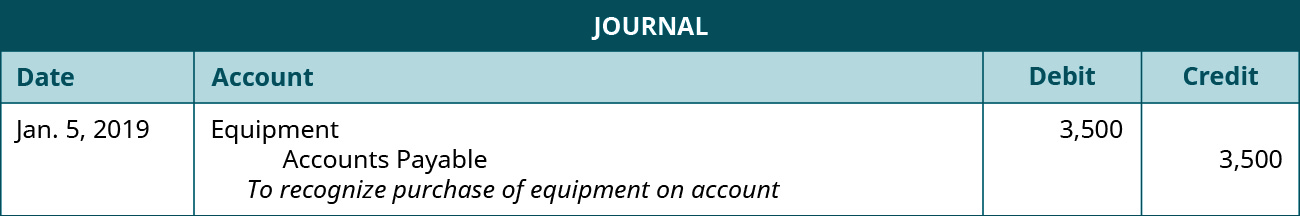

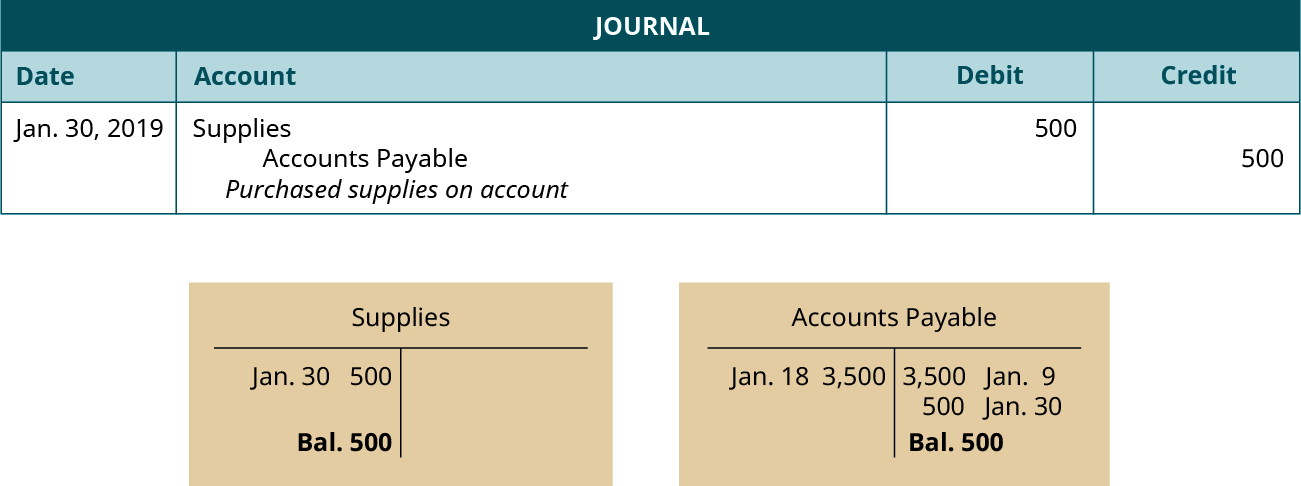

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

The Increase in Expenses.

. Prepare a journal entry to record this transaction. Nothing to record c. Debit your Computers account 10000 and credit your Cash account 10000.

All Topics Topic Business Careers Accounting Journal Entry - Supplies bought on credit Heaven7401 Posts. When a business transaction requires a. In this case the company ABC would make the journal entry of the purchase of supplies on March 19 2021 with the debit of office supplies account 3000 and the credit of accounts payable 3000.

Bale Company purchased 1460 of office supplies on account. What journal entry will pass in the books of accounts to record the purchase of goods on credit and payment of cash against the purchase of those goods. Office supplies used Beginning office supplies Bought-in office supplies Ending office supplies Office supplies used 1000 800 500 1300 Likewise the company ABC can make the journal entry for 1300 of the office supplies used during the period as below.

Paid cash for supplies journal entry. In the journal entry Cash has a debit of 20000. Modern rules of accounting applied US-Style Purchase AC Type Expense Rule Dr.

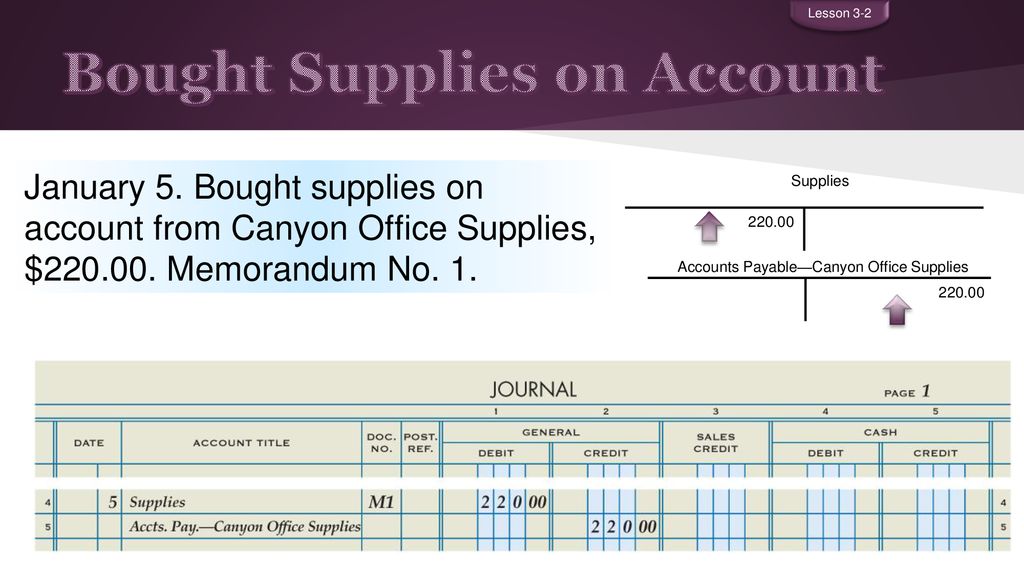

This lesson will cover how to create journal entries from business transactions. Accounts Payable Supply Company 165000. The accounting equation Assets Liabilities Owners Equity means that the total assets of the business are always equal to the total liabilities plus the total equity of the business This is true at any time and applies to each transaction.

Accounts Payable Supply Company 20000. Purchase Office Supplies on Account Journal Entry Example. Assume the purchase occurred in a prior period Date Accounts and Explanation Debit Credit ОА.

At the time when the purchases are made on credit terms then the purchases account will be debited in the books of accounts of the company which will be shown in the income statement of the company and the accounts payable account will be debited because with the credit purchase the liability of the company increases and this liability will be reflected in the balance sheet of. Debit Cash and credit Owners Capital. For this transaction the accounting equation is shown in the following table.

They also record the accounts payable as the purchase is made on the account. This is posted to the Cash T-account on the debit side left side. On January 3 2019 issues 20000 shares of common stock for cash.

Creditors AC Type Personal Rule Cr. Purchased supplies 750 on account. Also charging supplies to expense allows for the avoidance of the fees.

Credit Account Payable e. What is correct Journal entry. Prepare the general journal entry to record this transaction.

Journal entries are the way we capture the activity of our business. Debit Accounts PayableAvis Supply Company and credit Cash. Which Journal entry records the payment on account of those office supplies.

Sedlor Properties purchased office supplies on account for 800. 800 Accounts Payable Accounts Receivable OB. Despite the temptation to record supplies as an asset it is generally much easier to record supplies as an expense as soon as they are purchased in order to avoid tracking the amount and cost of supplies on hand.

Second to record the return of supplies. When the company purchases equipment the accountant records it into the balance sheet under fixed assets section. Third to record the cash payment on the credit purchase of supplies.

They need to settle the payable later. First to record the purchase of supplies on credit. Someone please please help.

Q2 The entity purchased 150000 new equipment on account. Accounts Payable Supply Company 185000. Common Stock has a credit balance of 20000.

Paid Cash for Supplies Accounting Equation. And credit the account you pay for the asset from. Credit Supplies O b.

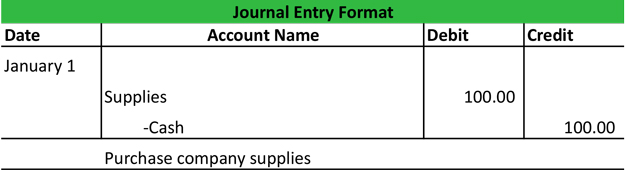

Thus consuming supplies converts the supplies asset into an expense. The following are the journal entries recorded earlier for Printing Plus. Lets say you buy 10000 worth of computers and pay in cash.

Journal entry for credit purchase. Purchased Equipment on Account Journal Entry. Despite the temptation to record supplies as an asset it is generally much easier to record supplies as an expense as soon as they are purchased in order to avoid.

Double-entry bookkeeping in accounting is a system of bookkeeping so named because every entry to an account requires a corresponding and opposite entry to a different account. Debit Accounts ReceivableAvis Supply Company and credit Cash. Purchased supplies 750 on account.

Thus consuming supplies converts the supplies asset into an expense. The correct journal entry for the transaction PAID CASH ON ACCOUNT TO AVIS SUPPLY COMPANY is. In business the company usually needs to purchase office supplies for the business operation.

Take a look at how your journal entry for purchase of asset might look. Debit Cash and credit Owners Drawing. Blanco Company purchased 2570 of office supplies on account.

I am having trouble with this problem although I know it must be simple to answer. Likewise when it paid cash for supplies it needs to make a proper journal entry based on whether it is on the purchasing date or it is on a later date for settlement the payable it has made on the purchasing date. 000 Accounts Payable Cash OC Cash Accounts Payable D.

Accounting questions and answers. Golden rules of accounting applied UK Style Purchase AC Type Nominal Rule Dr.

Purchase Office Supplies On Account Double Entry Bookkeeping

Paid Cash For Supplies Double Entry Bookkeeping

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Unit 5 The General Journal Journalizing The Recording Process Ppt Download

Business Events Transaction Journal Entry Format My Accounting Course

Chapter Journal Review Ppt Download

Recording Purchase Of Office Supplies On Account Journal Entry

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

0 comments

Post a Comment